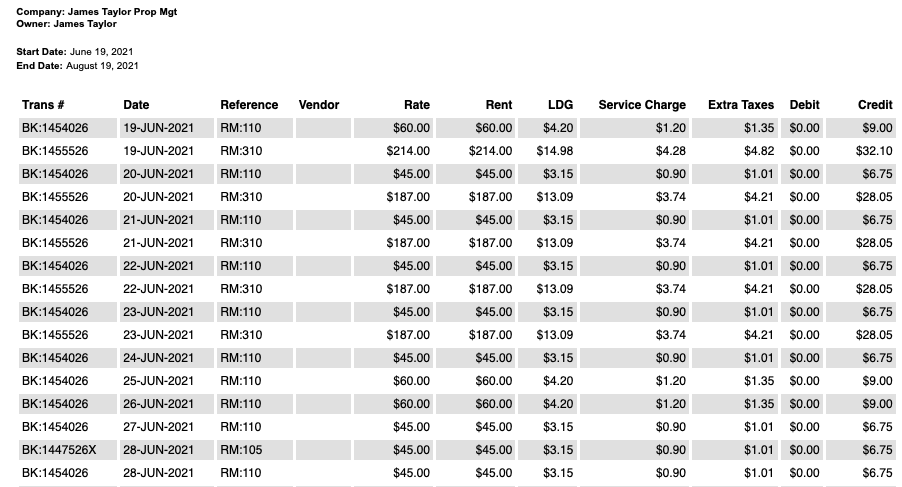

The Owners Statement provides detailed tracking of debits (expenses) and credits (accommodation income) due to the for each Owner Unit. This report is typically run at the end of a month or fiscal quarter to report bookings and corresponding financial transactions per unit. Note that a multi-day booking will list multiple times so that each day's unique Rate, Rent, and Tax are listed discreetly.

The Owner's statement can be generated for current, past or future date ranges. It displays the bookings, debits, and credits associated with the room number assigned to the Owner (use the Owner Statement Summary Report for future projections of bookings and revenue to Owners).

Each night of each booking is listed with the Nightly Rate in the column "Rate". If the booking is Active or Complete and Room Rent has been charged, the amount will appear in the column "Rent" with a corresponding commission due in the column "Credit". This report is intended to the used for actually paying or reconciling what will be owed, as it's based on actual dates stayed when Room Rent was posted. Thus, this report can be used to pay what is owed an Owner-owned Unit(s).

If the booking has not been charged any Room Rent yet, then the "Rent" and "Credit" column will remain at $0. Also, the columns for the Tax(s) the property collects only applies to RENT charged to the Folio. If the Tax(s) were removed or edited, the 'sum' of the tax(s) charged the day Rent was posted will appear on the column for each day of the stay.

The difference between this Owners Statement Report and the Owner Statement Summary Report is that the Summary report returns all bookings with an ARRIVAL date between the range, so that a SUMMARY can be sent to the Owner for what may/not actually occur with Room Rent. Whereas the STATEMENT report is meant to make a financial payment to an Owner, as the STATEMENT report tracks actual Room Rent added to the folio(s). Thus, the Summary report may list a Booking that arrives between the range, but no booking was actually checked in and had Room Rent posted between the dates, so the STATEMENT will not show it.

It is important to note that if you are taking Group Bookings that include an owner-owned unit or room, the transactions posted to the Group Master Folio will not automatically appear on the Owner's Statement. Only transactions (debits and credits) posted to the primary folio of Individual bookings display on this statement. For instructions on how to include the transactions posted to a Group Master Folio in a Group Booking, please see Owner's Statement - Group Bookings.

To generate Owner Statement, go to REPORTS | ACCOUNTING REPORTS

- Choose Owners Statement

- Choose a date range (this can either be in the past or future).

- Choose the Owner from the drop down list

- Click on the format of the statement: HTML, EXCEL, CSV

- Click generate report

The following information displays on the Owner Statement Report:

- Trans #: Booking or Confirmation #

- Date: Date of booking with each night listed starting with the arrival date and ending with the departure date. For example, a 3 night booking from April 10-13 would have three lines listed, one for each night of the booking.

- Reference: Room # assigned to booking. This corresponds to the Owner Unit.

- Vendor: If a charge has been made (Debit column), then the Vendor name will appear here.

- Rate: Displays standard nightly rate entered for the booking.

- Rent: Actual room rent charged for the night. If the booking is Active or Complete and Room Rent has been charged, the amount will appear here. If the amount is different than the rate, then an adjustment was made to Room Rent in the Folio. Please go to the guest folio and/or the Booking LOG to see why RENT was edited or removed.

- Tax(s): Actual taxes associated with RENT charged for the night. If the booking is Active or Complete and Room Rent has been charged, the tax(s) 'sum' for the day will appear here. If a tax was edited or removed after posting RENT, then this adjustment was made to the guest folio, and can only be understood by tracking the Booking LOG to see why a tax was edited or removed. In the sample below, the Site has 3 taxes associated with RENT: LDG, Service Charge, and Extra Taxes.

- DEBIT : Calculates any expenses charged to the unit AND the amount disbursed or paid to the Owner during the date range.

- CREDIT : Calculates the amount due to the Owner for commission. This is number is calculated with the commission % entered in the Owner information.