To add or modify taxes, go to SETUP | SETTINGS | TAX CONFIGURATION.

In this section, you can modify your primary currency (currency used across system), add new taxes, and edit current tax settings.

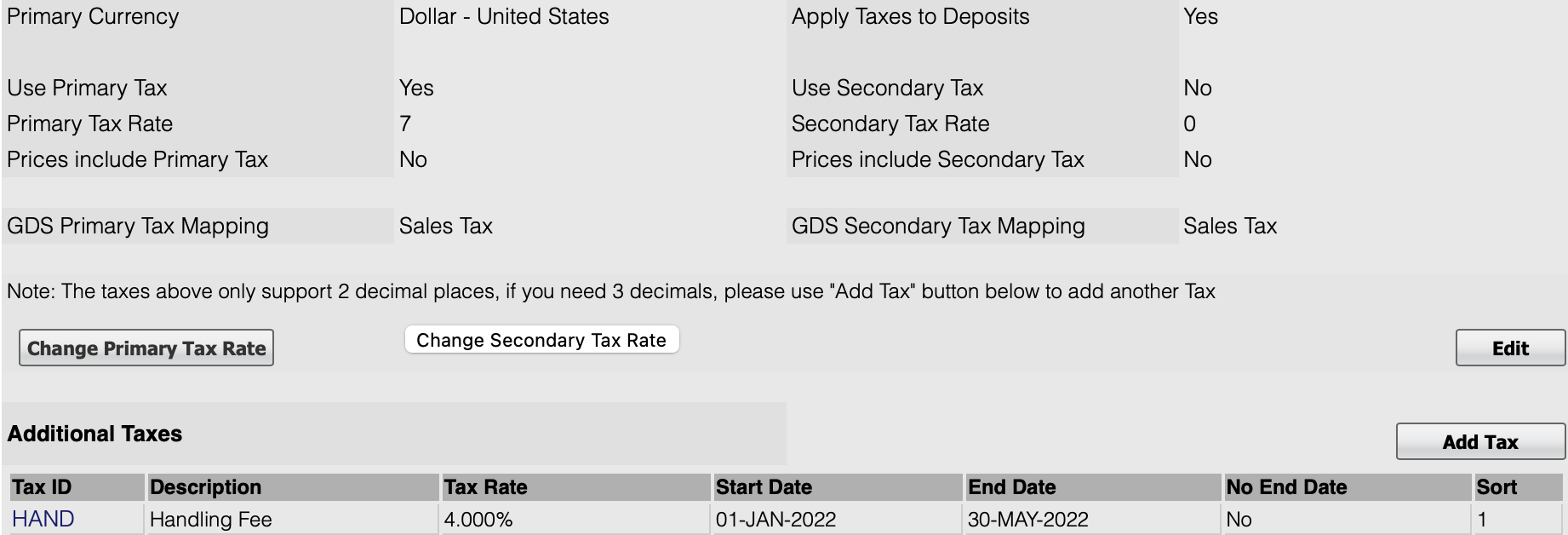

There are two main taxes, the primary and secondary tax. When these taxes are enabled, tax is automatically calculated on room rent in bookings, as well as any Inventory Items (which can each have unique tax settings), when posted to folios.

You can enable one or both of the Primary and Secondary taxes depending on your needs. If you have either Primary or Secondary Tax enabled, the values of these fields will automatically populate the RENT and Inventory items, with these taxes values. As many additional taxes can be added, such as a flat fee per night or a percentage, and applied to Room Rent and/or inventory items. This is useful for flat fees or sales tax on inventory items (such as Service Fees or Parking fees). See instructions below and more info at Additional Taxes.

To change the name of your taxes, go to Custom System Labeling.

OTA Tax Exempt

Because the global tax regime is changing to reflect OTAs such as Airbnb, VRBO, Expedia, Booking.com, and others who collect some or all of your hospitality taxes (and pay this to your tax authority directly), you have the ability to select for a specific OTA what we refer to as OTA Tax Exemption flags. What this means, is that one or more of the taxes you are using for Room Rent may be 'exempt' when coming via an OTA channel. We can set your OTA channel to be custom as you need it. so that the tax exempt flag is selected automatically when an OTA booking occurs. Just ask your Support Rep to make the desired tax exemption for each OTA you need a variation of 'exemptions' set.

Modify your current Primary and SecondaryTax Settings

To change the Tax Settings, click Edit.

Make any changes and click Save. To change the Tax Rate, go to the next step.

- Primary Currency: Choose the currency you will use in your daily operations. This will be used in MyPMS and on guest bookings.

- Apply Tax to Deposits: This is applicable only on the Booking Engine (Not through GDS or OTA connections). To calculate taxes on deposits taken for online bookings on your website, choose "Yes".

- Tax Settings for Primary and Secondary Taxes: Note, If you do not have Secondary Tax, then choose

- Use [Tax Name] Tax: Do you want to use this tax? Choose "Yes or No". To enable this tax to automatically calculate on room rent for guest bookings and folio charges, choose "Yes".

- [Tax Name] Tax Rate: The tax rate is displayed as a number representing the percentage, i.e.. 19 is a 19% tax rate. To edit the tax rate, go to the next step

- Prices include [Tax Name] Tax: Do you want the Room Rates to include Tax (such as VAT or GST regimes)? Choose "Yes or No". To itemize your Room Rent/Inventory Items Taxes on top of the rate, i.e., don't subtract the tax, choose "No". If your property is a 'Tax Inclusive' property (such as VAT or GST tax regimes) the Additional Taxes will not support Tax Inc settings, so a 'Tax Inclusive' property should have their taxes into no more than 2 discreet taxes.

- GDS [Tax Name] Tax Mapping: (GDS) If you are connected to GDS channels, then choose the name of the tax you want displayed.The GDS requires specific tax labels. Please choose the one that most closely resembles what you charge your tax for.. The label for taxes that you use for your website will not change and will display as entered in the primary and secondary taxes.

Modify your current Primary and Secondary Tax Rate

- Click on the button "Change [Tax Name] Tax Rate".

- This screen will appear. Enter the new tax rate and leave "Update Inventory Items" checked. This updates your manual Rent Rent Charge in Inventory items. Click Change.