? Choose Parameters from the BookingCenter menu or ? + U to display the Parameters window.

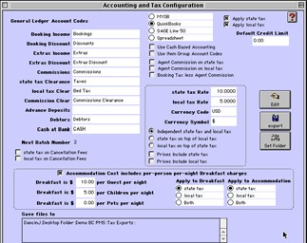

? Click on the Accounting and Tax button to display the Accounting and Tax Configuration window.

? Click on the Edit button.

? Enter the following settings if you will use the G/L export functions of BookingCenter:

General Ledger Account

Codes

Enter the corresponding codes used by your accountant to identify the financial headings used in your General Ledger system. We provide BookingCenter terms on the left. You should fill in the terms your accountant uses in the G/L system on the right to match up the import into QuickBooks, Sage,or M.Y.O.B. For detailed instructions and a list of commonly asked questions, please see the BookingCenter FAQs in the Support area of the website (www.bookingcenter.com).

Booking Income Summary of booking income generated between dates.

Booking Discount Summary of booking discounts offered between dates.

Extras Income Summary of extras income generated between dates.

Extras Discount Summary of extras discounts offered between dates.

Tax Clearance The total tax collected between dates.

Service Charges The total service charge (used often as a second tax) collected between dates.

Commissions The total amount of commissions owed to your property by Agents for bookings completed between

dates.

Debtors The total amount of commissions OWED to an Agent for bookings completed between dates.

Cash at Bank Currently an unused field.

Accounting Software• MYOB, Quickbooks, Sage - all popular accounting and financial management systems - are supported in addition to an Excel spreadsheet output. When one is chosen, the General Ledger output is presented in the format these programs can read via their import processes.

Agent Commission on Tax If chosen, Agent commissions will be taxed your tax rate.

Agent Commission on

Service Charge If chosen, Agent commissions will be taxed your service charge rate.

Tax on Cancellation Fees Select this option if you desire to apply tax to cancellation fees, if applicable.

Service Charge on

Cancellation Fees Select this option if you desire to apply any service charge to cancellation fees, if applicable.

Apply Tax Choose to apply your tax automatically to all booking charges. If not chosen, there will be no Tax applied

to Bookings.

Apply Service Chargee Choose to automatically apply your service charge. If not chosen, there will be no Service Charge applied

to Bookings

Tax Rate Enter your tax rate.

Srv Chg Rate Enter your service charge rate.

Currency Code Enter the standard three -character currency code for your country.

Tip Refer to the BookingCenter Online Checklist for a full list of codes.

Currency Symbol Enter the symbol used for your local currency (i.e. $).

Independent Tax and

Service Charges

Tax on top of Service

Charges

Service Charges on top of

Tax

Choose to establish the two taxes independently of each other.

Choose to tax the Service Charge in addition to the sale. Choose to add the Service Charge to the taxed total

Prices Include Tax Choose to make all booking costs include the tax, so that you back-end the taxes from your booking costs.

Prices Include Service

Charges

Accommodation Cost

Includes . . .

Choose to make all booking costs include the service charge, so that you back-end the service charge from your booking costs.

Check this Checkbox to display the options to tax teh per person daily breakfast feedifferent than the accommodation. If checked, enter the value of breakfast for Adults (Guests), Children, and Infants per night. Then select the different taxes and/or service charges that will be applied separately to the breakfast and the accommodation portions. This enables easier reporting for situations that, say, a Bed & Breakfast may face where the breakfast portion is taxed only the local tax rate and the lodging is taxed at either a separate Occupancy Tax rate or an occupancy tax PLUS the local tax rate. All calculations adjusting taxed values occurs automatically in BookingCenter and tax reporting is automated for pricing to guests and correct tax totals for the tax authority.

Save files to Enter the path where the export file will be placed.

Export Click this to export your financial data between a given date range. BookingCenter supports exports that

post both Cash-Based and Accrual accounting transactions. If managing through Cash-Based practices,

BookingCenter will export transactions that have been issued as bookings and receipts, regardless of the

date the booking will be supplied or the receipt is issued. If managing through an Accrual approach, a

property can export transactions that are Advance Deposits and post them to a Liabilities Account until

the booking's arival date, at which times it automatically posts the revenue to Booking Income. See the

QuickBooks and M.Y.O.B. detailed instructions in the BookingCenter FAQs of the Support area of the

website (www.bookingcenter.com) for more information.

Set Folder Click this to set the folder for exporting your financial data.

Note Each transaction in BookingCenter is assigned a BATCH number to preserve the integrity of the transactional-level export. This allows a user to re-exportBATCHES for the accountant if problems on importing arose.

Overview

Content Tools